King Tether and the Stable Coin Wars

Abstract

Tether (USDT) maintains its dollar peg due to the work of arbitrage traders. USDT could lose the peg in the event of an increase in perceived liquidity risk and/or credit risk. In September 2018, new stable coins entered the market. Soon after, rumors of Tether banking problems started to spread. USDT began to drop due to market participants getting out of USDT while arbitrage traders required higher returns due to higher perceived risks. Then, on October 14, large market participants triggered a 15% USDT flash crash. A large exodus from USDT has seen Tether redeem $680 million since then. Tether did not profit from those redemptions. Between September 29 and October 21, Bitfinex’s daily trading volume for all currency pairs dropped 83%. Unless Tether provides what the market demands (more transparency and regular audits), the Tether exodus will continue.

Tether is one of the least understood yet most important subjects in crypto. In this piece I will cover how the Tether arbitrage works and analyze Tether’s latest crash.

Table of contents

- What is Tether

- How Tether works: Tether & Bitfinex

- Tether arbitrage & the dollar peg

- Tether’s & Bitfinex’s solvency

- Tether’s liquidity crisis: let the Stable Coin Wars begin

- The aftermath

- Bitfinex inside job

- Conclusion

What is Tether

Tether is a cryptocurrency issued on the bitcoin blockchain via the Omni Layer protocol. It is a stable coin, where each tether in circulation is meant to be backed one-to-one by fiat currency held in deposit by either Tether Limited or Tether International Limited, two private companies incorporated in Hong Kong. Most tethers are in the form of USDT, backed by US Dollars. From here on I will use the words USDT and tethers interchangeably.

Tethers allow users to have access to a cryptocurrency pegged to the US dollar, which mostly eliminates the volatility associated with cryptocurrencies. USDT offers a distinct advantage over the US dollar: the ability to transfer funds over the bitcoin blockchain instead of via the banking system. Transferring USD funds over a blockchain is generally faster (and oftentimes cheaper) than transferring funds via the banking system.

More importantly, avoiding the banking system is very valuable unto itself for crypto exchanges, as banks are often not interested in servicing the needs of exchanges. Using tethers allows exchanges to outsource fiat custody to Tether. Avoiding the US dollar also helps exchanges stay further away from the long reach of US regulators, allowing exchanges to save considerable sums on compliance and personnel. Hence the proliferation of the so-called Tether exchanges i.e. crypto exchanges without fiat that use USDT rather than USD for trading pairs.

USDT is extensively used to arbitrage across crypto exchanges.

One should note that according to Tether, “Tether Tokens are backed by money, but they are not money themselves”. But, as the saying goes, if it looks like a duck, swims like a duck, and quacks like a duck, then it probably is a duck.

How Tether works: Tether & Bitfinex

Bitfinex and Tether are sister firms with shared directors, shareholders and management. Jan van der Velde is the CEO of both firms. All Tether issuance flows through Bitfinex before being distributed to other exchanges. Hence when looking into Tether one must also look into Bitfinex.

To cover how Tether works and its relationship with Bitfinex, I will borrow heavily on this excellent article by Robert-Jan den Haan. Its key points are:

- As per Bitfinex, Bitfinex is the only gateway in-and-out of Tether, i.e. Bitfinex is effectively Tether’s only direct customer. “Bitfinex and Tether decided on this change in late 2017 to put less strain on the banks processing Tether purchases”.

- Bitfinex purchases USDT from Tether by depositing the corresponding fiat in Tether’s bank account. On issuance, tethers are sent from the Tether wallet to the Bitfinex wallet, in round numbers.

- Bitfinex is a USD only exchange; tethers can’t be used to trade on Bitfinex.

- Bitfinex’s users can withdraw dollars in USDT format. A withdrawal in USDT format is effectively a USDT purchase. Customers can only buy USDT from Bitfinex, on withdrawal, and not from Tether directly.

- Bitfinex must maintain a USDT inventory to satisfy its users’ demand. Bitfinex purchases new tethers whenever its management decides, which would be whenever Bitfinex’s inventory of USDT is running low.

Readers can find more details on this Bitfinex quarterly update for shareholders of December 2017.

Tether arbitrage & the dollar peg

USDT maintains its peg with the US dollar due to two factors:

- On deposit, Bitfinex credits users’ accounts with 1 USD for every USDT deposited.

- When the price of USDT-USD deviates considerably from $1, arbitrageurs bring it back in-sync.

Arbitrage example: USDT-USD drops to 97 in Kraken, one of the few exchanges where it is available as a trading pair. A trader would buy USDT (using USD) in Kraken, transfer the USDT to Bitfinex, convert to USD at $1.0, withdraw USD, transfer the USD back to Kraken, and generate 3% in gross revenue. Arbitrageurs would perform the arbitrage trade whenever the spread would justify the operational costs and perceived risks, and, by doing so, would put upwards pressure on USDT-USD, pushing it towards $1.?—?More examples illustrating arbitrage by means of BTC-USD & BTC-USDT available here.

It is the work of traders performing arbitrage that keeps the value of an asset trading closely to its underlying value. Arbitrage consists of various legs (minimum of two). To perform the arbitrage, traders need a gateway to close the last leg of the arbitrage?—?in this case, a Bitfinex with a working banking relationship, allowing for fiat withdrawals.

Arbitrage traders are not making free money, they make profits by taking on four risks:

- Market risk?—?in the first example, the price of BTC may drop while the trader is transferring the BTC to Binance. Market risk can be eliminated almost entirely by hedging the BTC long exposure on a derivatives market such as Bitmex or the CME e.g. by temporarily shorting XBT.

- Execution risk?—?related to bid-ask spreads, falling under operational costs, yet unpredictable.

- Liquidity risk?—?related to delays in closing the last leg of the trade, which affect profitability given opportunity costs and the time value of money.

- Credit risk?—?of Bitfinex and/or Tether in the case of USDT. If either were to become insolvent before the trader processes the fiat withdrawal, the trader couldn’t redeem the USDT for USD.

Tethers could lose the peg and deviate considerably from $1 in the event of an increase in perceived liquidity risk and/or credit risk. In other words, if trust in Bitfinex or Tether diminishes, or if Bitfinex experiences banking issues, USDT would move lower.

In a fully efficient market, for as long as USDT is fully backed by USD, and that is known by all, and the Bitfinex withdrawals process is perfectly efficient, the USDT’s market price would remain close to $1 regardless of any buying or selling, due to the work of arbitrage traders. It is, of course, not a fully efficient market, particularly so because of bottlenecks in fiat deposits/withdrawals (more on that later).

Tether’s & Bitfinex’s solvency

Tether’s solvency

If Tether would not have USDT fully collateralized by USD, then Tether would become insolvent in the case of a bank run. The perception of the marketplace is of paramount importance. Tether does not want to prove USDT is fully collateralized by USD by having a bank run force them to buy all USDT back. That would be very bad for Tether’s business and survival.

Hence the importance of having balances audited. Tether did share a third party examination, by a law firm, where the law firm stated to be “confident that Tether’s unencumbered assets exceed the balance of fully-backed USD Tethers in circulation as of June 1st, 2018”. This examination has been harshly criticized by many because it was not an audit. However, as Cameron Winklevoss said:

In short, the criticism appears to be overblown. See this thread for more details. I have no reason to believe the law firm’s attestation is inaccurate and tethers are not fully collateralized. Even Michael Novogratz, CEO of Galaxy Investment Partners, a cryptocurrency investment firm, believes Tether has a dollar for every tether. The arguments from the “tethers not fully backed by USD” side are weak (more on that later), and the market behaves as if tethers were fully collateralized (more on that later as well).

However, Tether’s management has allowed the rumor mill to fester and spread by not addressing it with regular audits, the audits Tether itself committed to deliver in its whitepaper (“Professional auditors will regularly verify, sign, and publish our underlying bank balance and financial transfer statement”).

For as long as Tether doesn’t provide an audit or attestation for assets and liabilities, rather than for a single balance sheet line item, the possibility of no full USD backing, even if very low, remains.

Bitfinex’s solvency

Bitfinex is a small private company in the blockchain space. As with all private companies, its financials are, naturally, private information. All crypto exchanges are private companies. To look at comparables with public companies one has to look into legacy markets’ exchanges. That represents a flawed comparison given how different crypto and legacy markets are, yet it will remain all we have until a crypto exchange goes public.

I thus picked Euronext to do a basic comparative analysis. Euronext has 55% operating margins (excluding depreciation & amortization), while 20% of its revenue is for salaries and employee benefits.

On the other hand, Bitfinex trading revenue as of September 29 (before the crisis started yet still in the midst of depressed trading activity) was in the order of $770,000 a day ($548 million times 0.28% divided by 2), which would render $280 million a year (ignoring margin funding revenue). Bitfinex supposedly has slightly over 100 employees?—?so assume 100 employees for simplification purposes, and assume an average compensation of $120,000 a year. That results in $12 million a year for employees, about 4% of revenue. Assuming other ratios constant, Bitfinex would then have 71% operating margins (excluding depreciation & amortization), about $200 million a year in EBITDA.

Therefore, the probability of Bitfinex being insolvent is very low. Unless Bitfinex’s Treasury got hacked, which is always possible. The details of the 2016 hack remain murky.

Solvency crisis vs. Liquidity crisis

In economics parlance, a solvency crisis occurs when a company can’t meet its debt obligations through its assets, while a liquidity crisis occurs when a company has temporary cash flow problems.

In a liquidity crisis USDT is safe, and any crash no matter how deep is temporary.

Assuming tethers are fully backed by USD and Bitfinex is a profitable company, neither can become insolvent, and therefore there can be no solvency crisis. That leaves the marketplace facing potential liquidity crises. And in a liquidity crisis USDT is safe, and any crash, no matter how deep, is temporary.

Liquidity crisis: let the Stable Coin Wars begin

Tether’s liquidity crisis

Regular banking issues and inefficiencies in processing fiat deposits & withdrawals place Bitfinex always a step away from a liquidity crisis. See for example Bitfinex’s new “Improved Fiat Deposit System”, a system so slow that it may take a user 12 business days to have a fiat deposit processed. On the withdrawals side, this thread by IamNomad contains multiple links illustrating recent problems. In short, Bitfinex is an exchange always susceptible to a bank run. And it is then that the perfect storm hit.

New stable coins

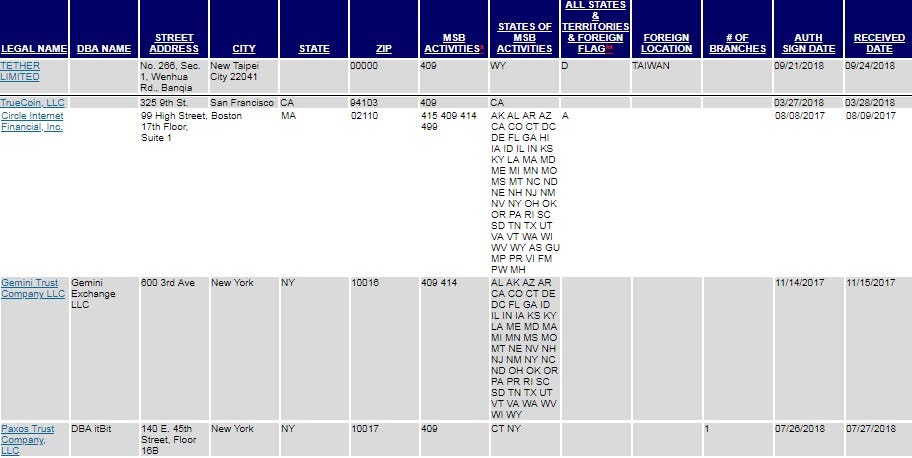

First, a myriad of new and seemingly more trustworthy stable coins, tethers’ competitors, hit the market. Gemini launched the Gemini dollar(GUSD) on September 10, Paxos Global launched the Paxos Standard (PAX) on September 10, and Circle launched USDC on September 26. Finally we have Trust Token project’s TrueUSD (TUSD). All four (GUSD, PAX, USDC, TUSD) perform attestations proving reserves rather than audits, just like Tether did. However, unlike Tether, they are based in the USA, they are hiring real auditing firms, and they promise monthly or bi-weekly attestations. Just like Tether, all four are registered with FinCEN, while two of them are also regulated by the New York State Department of Financial Services. Interestingly, Tether only registered with FinCEN on September 2018. Tether does have one major advantage going for it: it has no backdoor, like USDC has.

FinCEN registrations

Banking problems

Second came the banking problems rumors, starting with Tether’s bank (Noble Bank) having financial troubles (September 30). That is the day Tether lost its peg. The market picked up the news a day later and Tether suffered its first crash (-5% intraday) since February’s CFTC related panic.

Those rumors soon transformed into Tether in the process of leaving Noble Bank (October 2), Tether not banking with Noble Bank any longer (October 3), Bitfinex now banking with HSBC (October 6), Bitfinex banking with HSBC is fake news (October 10), Bitfinex not banking with HSBC any longer suspends all fiat deposits (October 11), and lastly Bitfinex now banking with Deltec Bank (October 16). Rumors aside, it seems that only deposits at Bitfinex were ever halted, not withdrawals, and that Bitfinex was at no point “unbanked”. Yet even if withdrawals were still taking place, it would make sense for the withdrawals process to have been slower than usual.

As Travis Kling said (source): “you have the potential for funds to start using this Noble Bank narrative as a weapon to get market cap out of Tether and into the stable coins that they back”.

Conspiracy theory

For the conspiracy theory lovers, one must admit that the timing of the Bitfinex banking stories coinciding with the arrival of the new stable coins was remarkable. Also noteworthy is how Binance’s CEO started pitching Tether alternatives publicly on September 27, right after listing PAX on September 21 (see here, here, here and here).

The Perfect Storm

For two weeks Tether rumors spread like wildfire and USDT kept on dripping lower, reaching $0.975 on October 14. With the dropping USDT the spread between crypto fiat exchanges, such as Coinbase, and Bitfinex and Crypto tether exchanges, such as Binance, increased in line. Panic started creeping in.

USDT was falling because of market participants getting out of USDT, into other stable coins and other cryptocurrencies, while arbitrage traders required higher returns to perform the USDT arbitrage due to higher perceived risks, stemming from either real or perceived withdrawals issues, or due to FUD driven solvency concerns.

Traders were less willing to arbitrage the USDT spread, requiring higher returns to take on the arbitrage risks.

Meanwhile BTC-USD margin shorts at Bitfinex were close to all time highs. Now take into account that less tether arbitrage taking place translates into less selling of BTC-USD on Bitfinex, keeping the offer side of the book thinner.

Then on October 14 some large market participant or set of market participants triggered a USDT flash crash form $0.975 to $0.85 in two hours, in what seems to have been a hunt for stops, Bitmex Maintenance Pump style. Market participants sold USDT against USD, other stable coins, and other cryptocurrencies. While USDT-USD reached $0.85 in Kraken, TUSD-USDT in Binance traded $1.24, and BTC popped 19%-21% in Bitfinex and tether exchanges. The bitcoin pump was so large it even broke into bullish market territory temporarily. A tether driven optical illusion. All stops went with it. The stops run spilled over into crypto fiat exchanges as well (i.e. non-USDT markets): BTC prices in Coinbase and Bitmex spiked 10%.

Then rumors of Bitfinex normalizing deposits on the day after started circulating, while crypto prices retraced 75%, and USDT prices stabilized in the $0.94–$0.95 range. Three hours after the crash began, with prices already stabilized, Bitfinex officially announced the resumption of deposits for all customers (something Bitfinex had never confirmed had been stopped). That marked the end of the perfect storm.

Should be noted that triggering a stop run represents a valid trading strategy, employed in all markets, and by itself by no means does it imply market manipulation (i.e. market manipulaiton may or may not have taken place). Observers oftentimes confuse speculation with manipulation.

Price analysis

During the perfect storm crypto prices in fiat exchanges went higher rather than lower, and remained higher after. As markets are discounting mechanisms, price action indicates the majority of the market implicitly agreed Bitfinex was/is not facing a solvency crisis.

That is, of course, a narrative, attempting to explain the past. However one should not forget that in the event of a solvency crisis Bitfinex would go down, causing significant losses among investors and likely kick-starting a widespread risk-off move where many market participants would cash out their crypto in fiat exchanges. Or are we now suddenly expecting one of the main crypto exchanges going down be bullish for BTC-USD? The answer is “no”. Let’s recall how Mt. Gox brought bitcoin prices down 55% in two months, between February 2014 and April 2014 (from $780 on Feb/6/2014 to $350 Apr/11/2015).

In hindsight many said it was obvious a Tether crash would make crypto prices spike, as money flowed out from USDT to bitcoin and alts. That is hindsight speaking. Before the fact many professional traders believed a USDT crash would send crypto prices crashing. Furthermore, recall that in the prior three tether panics (which I covered in detail in this article), in two of them bitcoin prices crashed. Finally, one could argue that, in a fully efficient market, traders moving out of USDT into BTC could be done without any impact in the price of BTC-USD in fiat exchanges.

The aftermath

Bitfinex’s/Tether’s reaction

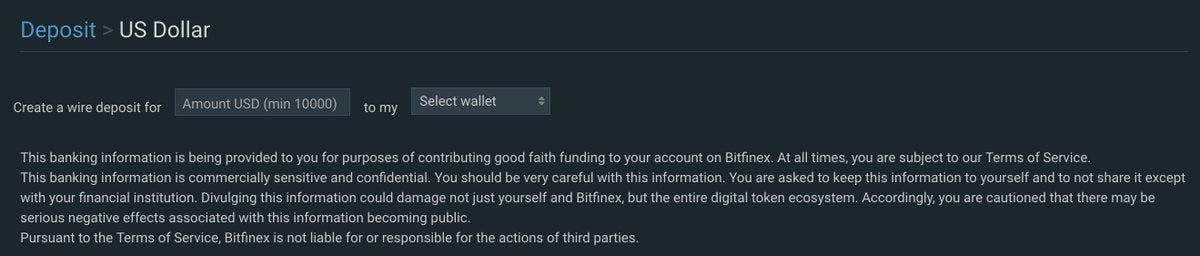

Throughout the two week ordeal (Sep-30 to Oct-14), Bitfinex continued with its dismal public relations practices, not fully addressing issues or accusations, or not doing so in a timely fashion. Consider that, aside of announcing on October 15 that deposits would be fully resumed the day after, their only other official communiqu? was this “Response To Recent Online Rumours” from October 7.

Furthermore, once deposits resumed, Bitfinex started displaying this notice on the deposits page, stating “Divulging this info could damage not just yourself and Bitfinex but the entire digital token ecosystem… you are cautioned that there may be serious negative effects with this information becoming public.”

USDT redemptions

Did Bitfinex buy their own tethers and cash-out the difference? Has Bitfinex been cashing out the difference? Given Bitfinex’s inside knowledge about their own liquidity and solvency, one would argue that, if Bitfinex is indeed solvent, Bitfinex would be the ideal party to arbitrage the spread between USDT and USD. Bitfinex would be the ideal Plunge Protection Team. As Hasusays:

“ That is fine and there is nothing shady about it. It’s no different from public companies buying back their shares when they think the market undervalues them relative to their fair price.”

As pointed out in this article, Tether has been redeeming USDT at an accelerated pace, withdrawing $790 million from a Bitfinex wallet to the Tether wallet since the crisis started on September 30 (until October 23), of which $680 million were withdrawn between the October 14 crash and October 19.

These redemptions, however, imply no arbitrage from Bitfinex, as the conversion from USD to USDT at a 1:1 ratio happens upon deposit at Bitfinex, i.e. the cost for Bitfinex of all USDT in the Bitfinex treasury wallet is $1. The USDT arbitrage is done by the party depositing USDT at Bitfinex. Hence for Bitfinex to be arbitraging using USDT, Bitfinex would need to be buying USDT in another exchange, and transferring it to Bitfinex. In conclusion, the redemptions responded to the great sums of USDT that were deposited in Bitfinex, and did not represent arbitrage unto themselves.

That does not mean Bitfinex arbitraged itself by buying USDT in other exchanges. Bitfinex may have been an active market participant in the USDT arbitrage trade because, as already stated, Bitfinex is the only market participant with full information, and the spread became too large to be ignored. That would represent no exit scam. In addition, it is of no consequence for the marketplace who arbitraged USDT, if Bitfinex wouldn’t have participated, others would have taken its place.

One could theorize Tether would not want to redeem USDT to maintain market share, yet Tether does not decide its market share, the marketplace’s demand does.

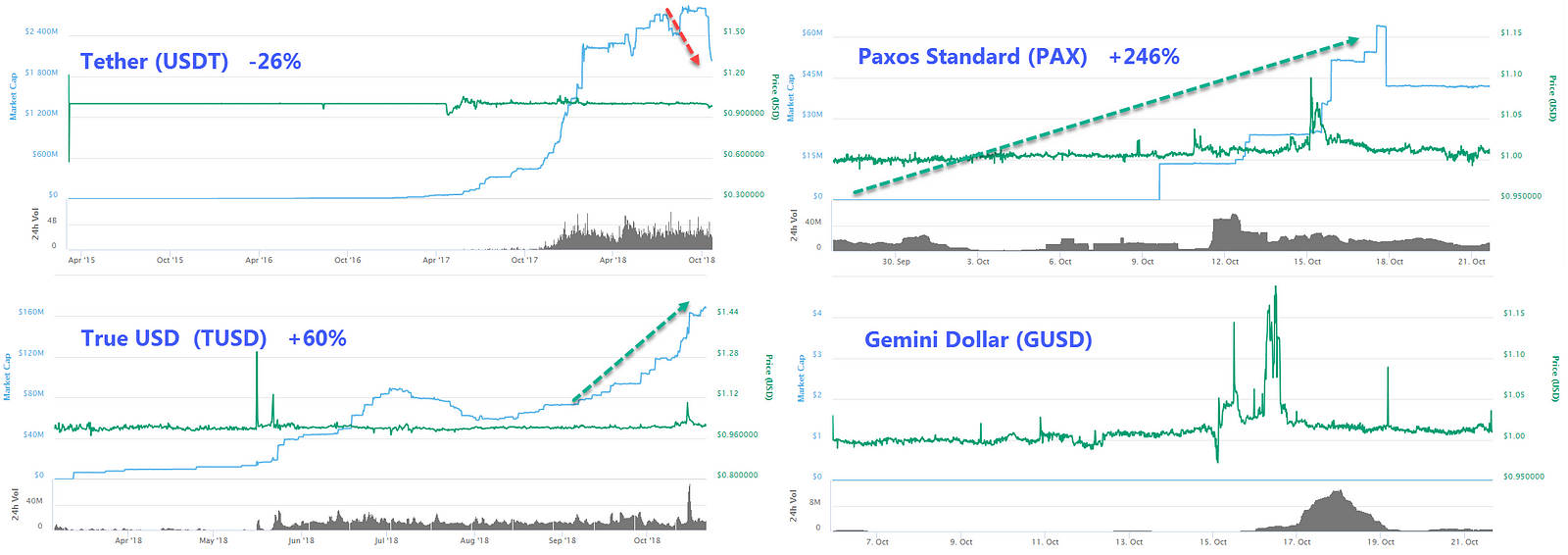

Stable coins re-balancing

Between September 29, right before the crisis started, and October 21, according to Coinmarketcap’s data USDT’s market cap dropped by $737 million, a 26% drop. Meanwhile the market cap of TUSD increased from $104 million to $167 million (+60%) and that of PAX increased from $12 million to $42 million (+246%). Data for GUSD is not available, although GUSD is the smallest of the four. That translates into a net outflow from stable coins into either bitcoin and altcoins or fiat of approximately $640 million; that split is not known.

Consequences for Bitfinex

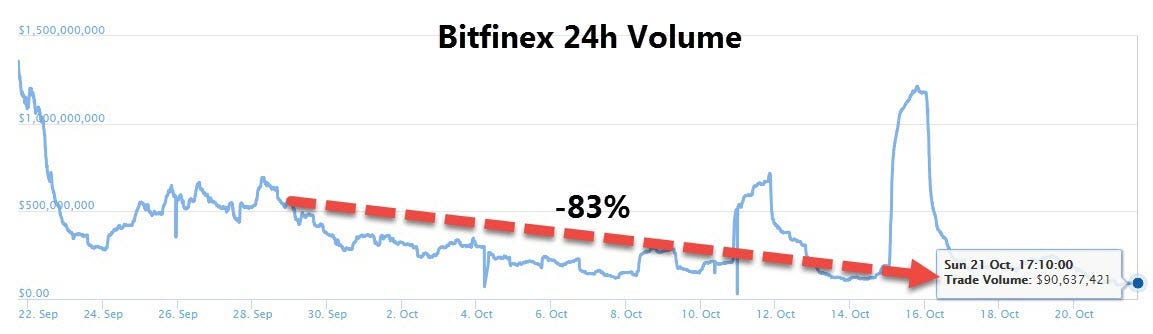

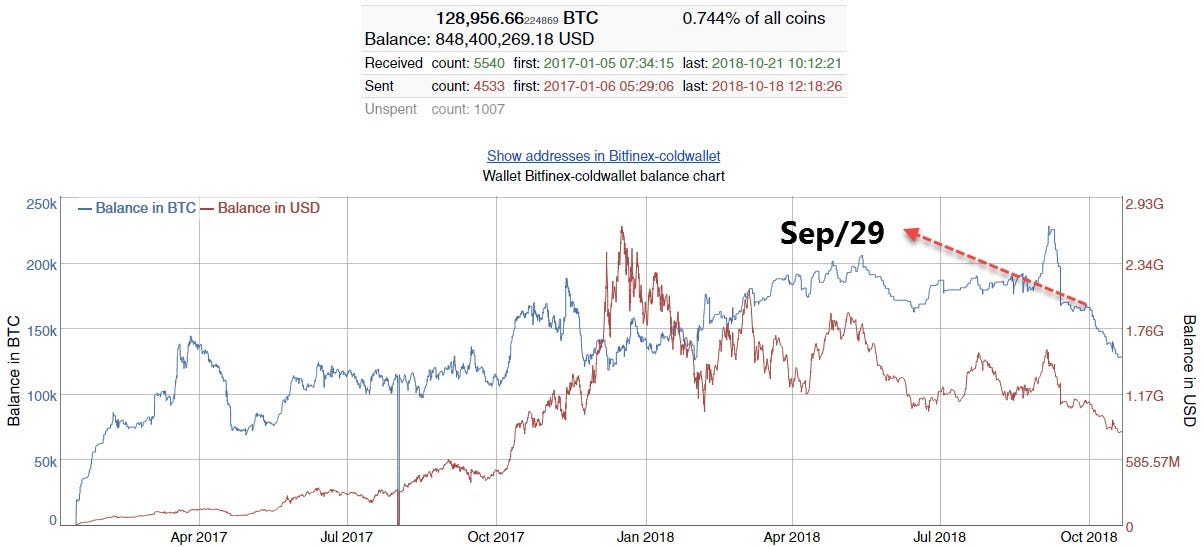

Bitfinex’s daily trading volume for all currency pairs dropped from $548 million on September 29 to $91 million on October 21, a mammoth 83% drop. In parallel, Binance saw its volume drop by 53%.

Meanwhile the balance in Bitfinex’s bitcoin cold wallet went in that period from BTC 168,000 to BTC 129,000, a 23% drop, while balances at exchanges such as Kraken, Bittrex and Bitstamp remained about unchanged, and balances at Binance increased by 8%. Notice how the drop at Bitfinex begun precisely on September 30.

Bitfinex inside job

Some have suggested the USDT crash was an inside job by Tether based on how Tether redeemed $790 million since the crisis started, making about $30 million in the process (see for example this tweet by Ran NeuNer). Such claims make no sense, for the following reasons:

- As already explained in a prior section, the USDT arbitrage is done depositing USDT at Bitfinex, and not by redeeming the USDT at the Bitfinex treasury wallet, for which Bitfinex already paid $1 each.Bitfinex must redeem USDT when demand for USDT drops, and does not make money in the process.

- Anyone can perform the arbitrage, Bitfinex could only garner a fraction of the spread to be arbitraged, not the full amount.

- Before the crisis, Bitfinex was making $30 million in revenue every 40 days just in trading fees, without taking into account the 0.1% charged on deposits and withdrawals.

- Before the crisis Tether had $2.8 billion dollars in underlying funds. Given current short term rates (the Federal Reserve has been raising rates aggressively in the last two years), a well managed company should be making at least 2% per annum on its cash, likely more. Therefore, on $2.8 billion dollars, Tether (if well managed) would be accruing at least $56 million a year in earned interest.

As already discussed, the Tether crash saw Bitfinex’s volumes drop 83%. Assuming constant volumes hereon, its yearly revenue would now be $233 million lower. Meanwhile, given the redemptions, Tether’s interest yearly revenue would now be $15 million lower. Therefore, Bitfinex’s/Tether’s management would need to not be very smart to throw away $248 million in yearly revenue just to make $30 million one time. Attempting to reduce losses by arbitraging USDT would make sense. Throwing away your business, your cash cow, to make $30 million does not.

And if Tether is a scam after all, why not just run with whatever is left of the $2.8 billion dollars, or orchestrate a self-hack for all bitcoin and tethers in their treasury wallets? $30 million should be pocket change for them.

Conclusion

The tether crash came and went. Arbitrage traders, large traders running stops, competing stable coins, and click-bait journalists profited, while Bitfinex/Tether and those who panicked (small traders and investors) lost.

The exodus from Tether should continue given the existence of seemingly better alternatives. Hopefully such exodus will be orderly. It may not be so. We may see more panic runs.

To stop the bleed, Tether could provide what the market demands: more transparency, regular audits (i.e. third party attestations performed by a trustworthy auditing firm), and better and more timely communication. As CarpeNoctom pointed out, “Bitfinex need much more transparent & offensive PR”.

Hurry up! The last month of Serial Hacking before the Grand hackathon in Asia!!!

Serial Hacking is a series of...

SerialHacking is a series of blockchain hackathons. You can participate and claim victory in one or several hackathons....

Russian Tech Week 2018 is a week of immersion in world technologies where you will receive knowledge and connections...

/rating_on.png)